The open storage sector is characterised by burgeoning occupier demand, boosted by a sharp rise in requirements for EV charging sites. However, demand remains high from a broad range of ‘traditional’ and ‘new’ open storage users.

Rents in the sector have traditionally been undervalued, with many regional markets historically trading at around £1.00 per sq ft. As occupier demand has increased and the focus has shifted towards higher quality sites, rents have risen sharply amid constrained supply. This was initially focused on locations in the London/M25 area, but is now rippling out to many other parts of the UK. Given the ongoing shortage of high quality, well-located sites relative to demand, there is certainly scope for further rental growth across the UK.

For investors, the sector has many other attractive features. Open storage sites can be upgraded with relatively low capital expenditure, as have a low exposure to risks such as tightening MEES regulations. In addition, many sites have longer-term development potential.

It is therefore not difficult to see why property funds are so keen to gain exposure, and the sector is appearing increasingly large on their radars. We are aware of several major players who have recently committed significant funds to acquire sites, following a period of evaluation.

However, market entry at scale remains challenging, and we have seen a rise in competitive tension, with several buyers now looking at the bigger lot sizes of £40 million+. Mileway, for example, has been growing its portfolio, with acquisitions at Ridham Dock in Sittingbourne as well as Tank Farm in Purfleet and Link Heathrow.

Where is the greatest potential?

Carter Jonas is tracking the evolution of rents for top quality Class 1 sites as the open storage market evolves, revealing wide variation between locations. In the Greater London / M25 area, prime rents in key markets now vary between typically around £5.00 and £10.00 per sq ft, whilst pricing in the regional markets is still much lower, ranging from typically around £2.00 to £4.00 per sq ft. All these levels represent significant increases over the last two years.

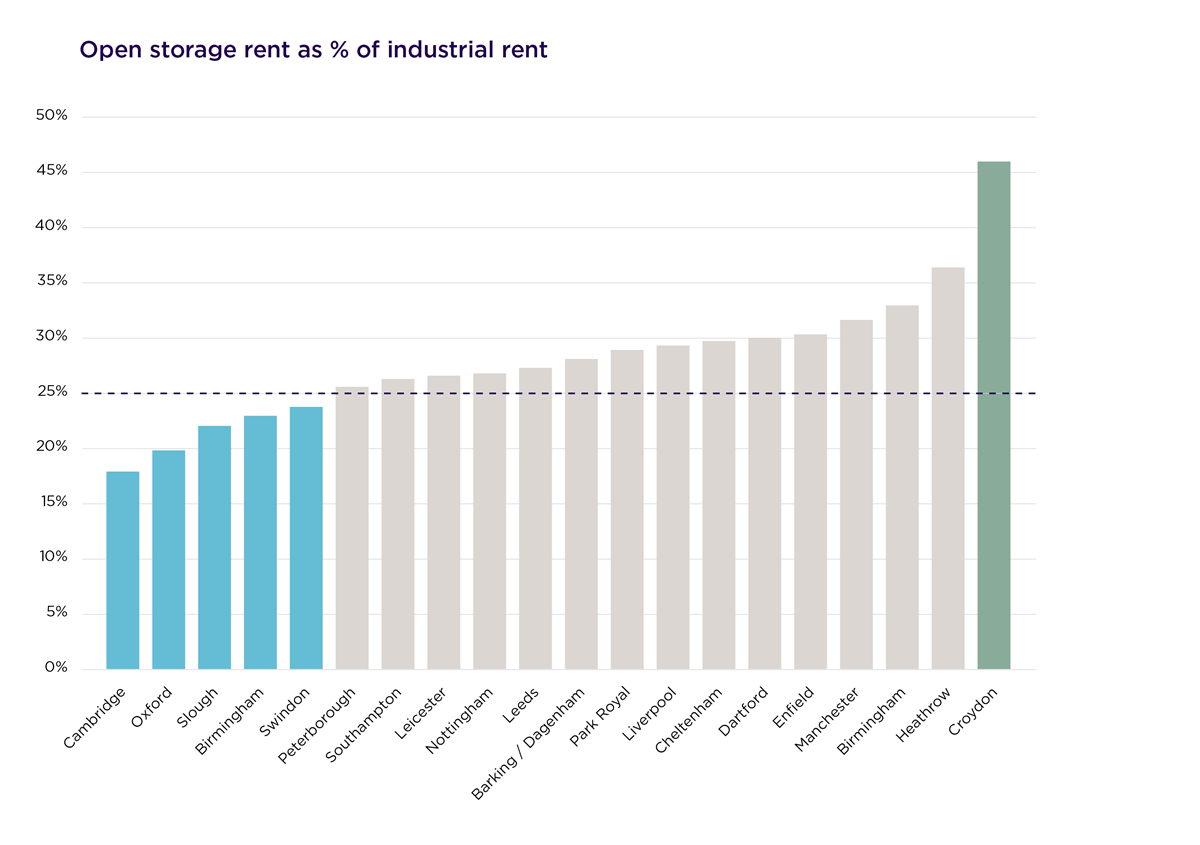

As well as open storage, we also regularly monitor prime rents for traditional industrial/distribution units. Using this data, we have assessed the rental growth potential across 20 key open storage locations by looking at relative rental pricing of open storage compared with industrial.

Figure 1 illustrates our analysis by key location. This shows that open storage rents predominantly lie within a range of 25% to 36% of rental levels for traditional industrial property (grey bars). Croydon is clearly an outlier with relatively high open storage rents relative to industrial rents (45%). However, in five of our monitored locations, open storage rents are less than 25% of standard industrial rents (blue shading). Open storage rents in these locations look relatively undervalued and could therefore have greatest growth potential.

Figure 1

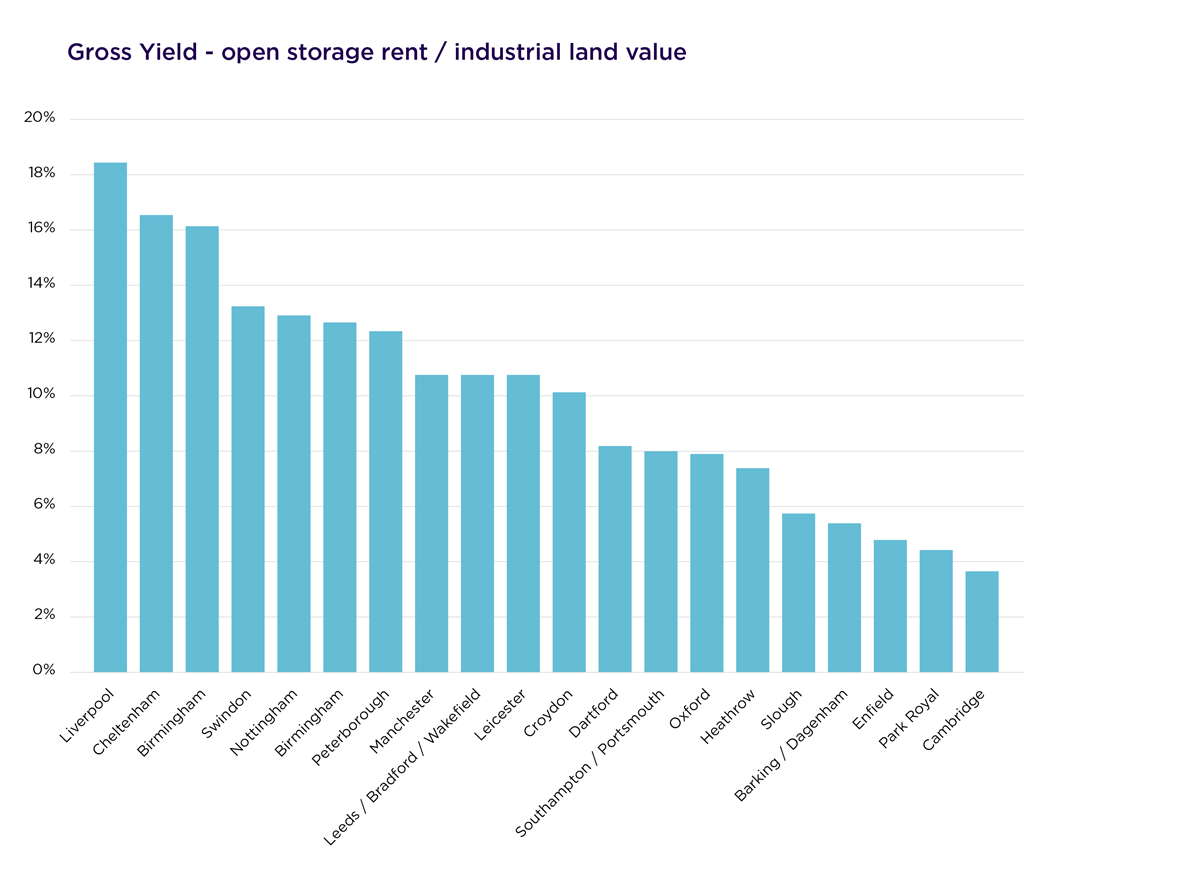

We have also calculated a notional gross yield for open storage sites across the locations we monitor, based on the open storage rent and the industrial land value. This reveals significant variation (see Figure 2), indicating where value may lie.

We believe that locations with gross yields in excess of 10% suggest excellent value on this measure. 11 out of our 20 monitored locations fall within this category. The top three locations are Liverpool, Cheltenham and Birmingham, and the regional markets generally show better value than those in London/M25 (it should be noted that values are lower in some locations, for example Cambridge, Park Royal and Enfield, as these markets are relatively inactive).

Figure 2

Of course, it is important to note that the potential for growth in values is subject to local market supply and demand conditions and the specifics of individual sites. But locations such as Birmingham, which does well on both of these metrics, could offer the potential to outperform.

Overall, however, the highly positive dynamics of the sector will make a wide range of in-town or -edge-of town locations in the UK highly attractive for sites that are suitable for open storage use.

Find more about open storage on our latest Open Storage Update report, which analyses the outlook for the sector, written by our research team and property experts.

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.