Central London Net Effective Rents Monitor Q3 2023

The Carter Jonas Net Effective Rents Index

Our Central London Net Effective Rents Monitor illustrates the combined impact of changes to both headline rents and the typical length of rent free periods across 22 central London districts.

The Index also reflects different lease lengths by providing analysis of five and ten year leases, which can have a significant impact on the net effective rent for each district.

Note: the impact of the timeframe for the ingoing tenant to carry out its fitting out works has not been factored into the Carter Jonas net effective rent analysis simply because the timeframe will be influenced by the quantum of space to be leased.

Overall central London trend

Our rental index for the whole of central London shows that prime headline rents increased by 0.4% during Q3 2023 (taking a weighted averaged across all the districts we monitor). The central London prime rent has risen by 3.4% over the last 12 months and is 2.6% higher than its previous (pre-pandemic) peak in Q1 2020.

As is typically the case during the upward phase of the rental cycle, landlords have been increasing headline rents rather than reducing rent free periods. There has been no significant change to typical rent free periods during Q3 2023 across the key central London districts, and only minimal change over the last year. As Figure 1 illustrates, this means that prime net effective rents have not recovered to the same extent as headline rents since the pandemic. As at Q3 2023, prime net effective rents (assuming a five-year lease) are just 0.3% higher than the pre-pandemic peak, compared with prime headline rents, which are 2.6% higher.

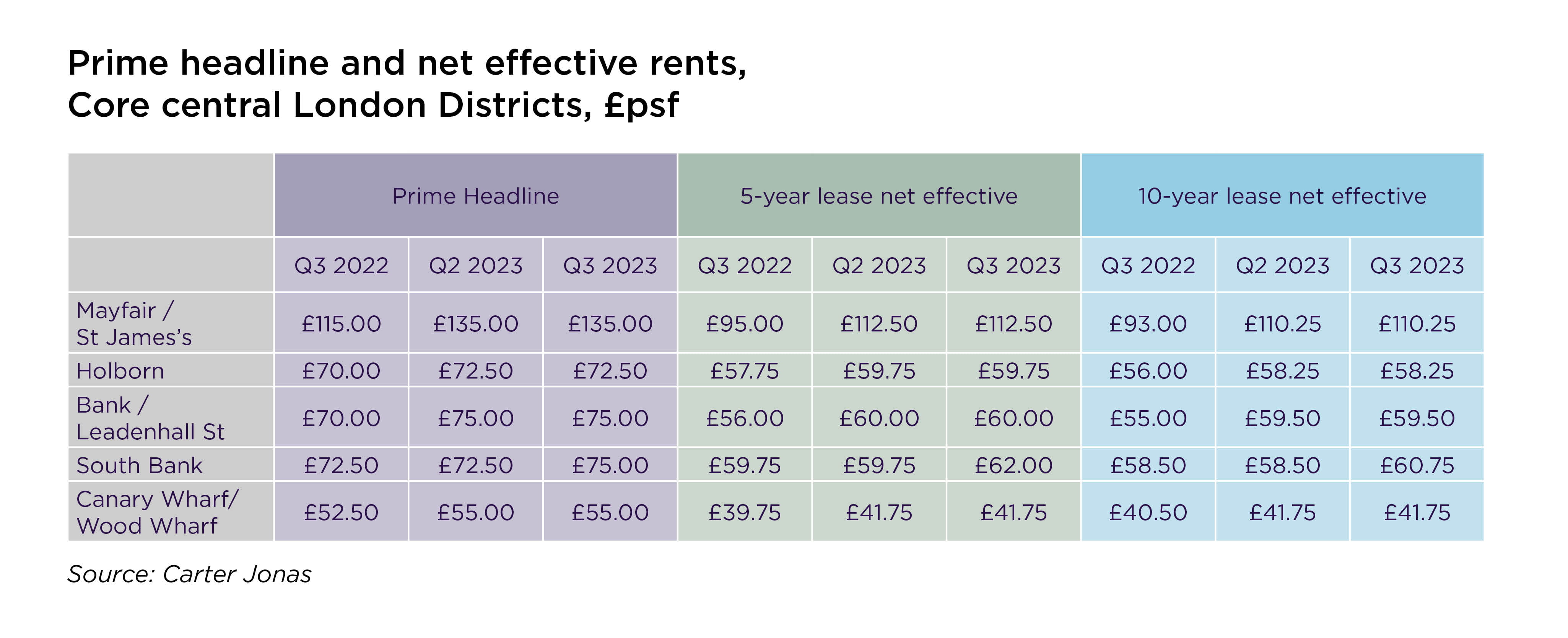

Rental growth across the key districts

The core West End districts of Mayfair and St James’s saw a pause in rental growth during Q3 2023. This follows a period of phenomenal growth over the last two years reflecting very low vacancy for high quality, sustainable, grade A space and strong competition amongst occupiers for the best in class space. The prime headline rent for Mayfair and St James’s has risen by 22.7% since Q3 2021, to £135 per sq ft per annum (and indeed for ‘super-prime’ space, we have recently seen rents agreed at over £180 per sq ft per annum). In addition, rent free periods have reduced by typically two months over the same period. As a result, the prime net effective rent has increased by 27.8% over the last two years (assuming a five-year lease).

Outside Mayfair and St James’s, many of the West End’s districts saw an increase in the prime headline rent during Q3 2023, again due to low vacancy and robust occupier demand, including Fitzrovia (+2.6%), Soho (+2.6%), Victoria and Westminster (+1.3%) and Marylebone (+1%). These rental increases mean that the West End submarket as a whole (taking a weighted average of the prime rents across the districts we monitor) saw a rise in the prime headline rent of 1.2% (with no change in rent fere incentives). There was no change to typical rent free incentives during Q3.

The core City of London district around Bank and Leadenhall Street has seen stable prime headline rents over the last two quarters. However, this follows strong rental growth and a modest reduction in rent free incentives in late 2022 and early 2023, meaning that the prime net effective rent is 8.3% higher in Q3 2023 than a year previously. Whilst the prime headline rent remains at £75.00 per sq ft per annum, the upper floors of buildings such as 8 Bishopsgate and 40 Leadenhall Street are reportedly achieving rents well over £90.00 per sq ft per annum and over £100.00 per sq ft for the top floors.

The overall picture across most of the City of London’s districts was one of stable rents during Q3 2023, with a good selection of grade A buildings available in most markets. However, the quarter saw some notable exceptions, with the South Bank seeing a rise in the prime headline rents of 3.4% to £75.00 per sq ft per annum, putting the district back on a par with the core City of London. Indeed, headline rents approaching £100.00 per sq ft per annum have reportedly been agreed on the upper floors of some new developments with a river frontage.

The Shoreditch market has continued to see a fall in prime net effective rents, at -3.6% during Q3 2023, and by -7.9% since Q1 2023, due to a combination of falling headline rents and lengthening rent free incentives. This is largely being driven by weaker demand from the global tech firms, which form a key part of this district’s occupier base.

There was no change to headline rents or rent free periods in Docklands in Q3 2023

Outlook

Occupier demand in central London remains more resilient than many other UK office markets, assisted by a broad occupier base of both national and multinational firms. Against a backdrop of ongoing economic and geopolitical uncertainties together with a constrained supply of quality space, the overall picture for the grade A central London office market over the next few quarters is likely to be one of stable headline rents and rent free periods.

Importantly, there will be exceptions to this outlook. Those prime West End locations with the greatest demand/supply imbalance are likely to see a further contraction in rent free periods and some limited rental growth for best in class grade A stock, reflecting the laser-like focus of occupiers on quality space with good sustainability credentials. This will be most apparent in Mayfair and St James’s, where occupier demand has been particularly strong and where vacancy levels are at historic lows. New grade A schemes completing in this market over the next year are likely to experience intense competition and achieve record rents.

Conversely, some non-core locations across central London, where there is a better balance between supply and demand, may well see a modest increase in typical rent free incentives for prime space in the coming quarters.

Our contributors

© Carter Jonas 2023. The information given in this publication is believed to be correct at the time of going to press. We do not however accept any liability for any decisions taken following this publication. We recommend that professional advice is taken.