In a volatile and developing market, Carter Jonas’ brokerage platform helps clients to find the best PPA price for your export, supply as well as options for sleeved PPAs and gas and electric supply contracts.

See below for this week's latest on the UK & EU gas, UK power & renewables and the oil & carbon markets, in partnership with PPAYA.

Weather

UK temperatures are sat roughly at seasonal normal levels and are expected to remain at these levels for the next few weeks. Temperatures across Europe are expected to fall back to SNT from a brief high point this week.

UK & EU Gas

Front-Month: 127p/th | Summer25: 122.7p/th | Winter25: 115.5p/th

Long term forecasts are pointing to cooler weather. EU TTF MA prices are climbing by around 3% today to sit at €50.2/MWh. US Freeport LNG started up once more after an outage the day before yesterday spooking the market, which tempered proceedings at the close of Wednesday trading.

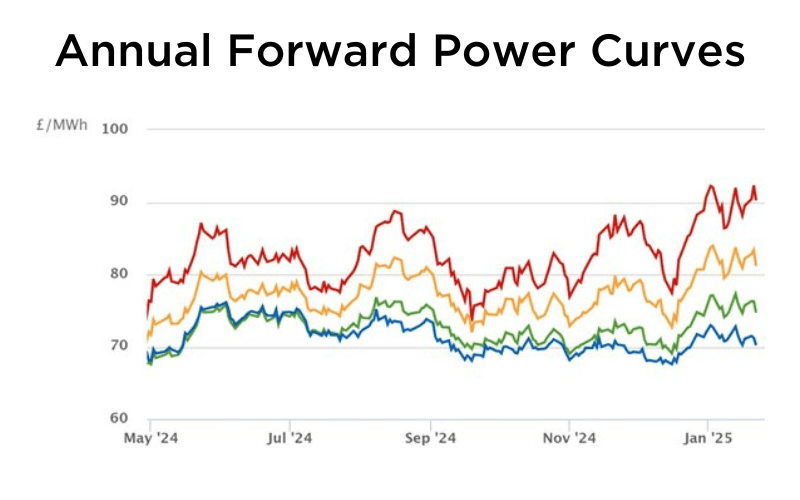

UK Power & Renewables

Front-Month: £105.25/MWh | Summer25: £88.8/MWh | Winter25: £91.75/MWh

The front-season yo-yo’d back to its previous peak this morning though. UK wind output is sat at around seasonal normal levels and is forecast to remain at these levels going forward. Day-ahead daily average fell to £106.24 for 23Jan delivery, and pushed lower again to £95.27 on 24Jan as the warm, windy weather takes over.

Oil & Carbon

Brent Crude: $79.2/bbl | EUAs: €81.6/t | UK Credits: £33.5/t

Oil prices remain broadly level as speculation remains regarding the impact of US sanctions and tariffs. EUAs sit at €81.6/Tonne. Prices rise rapidly this morning or greater fossil output. UK credits rise marginally to £33.5/Tonne.