In a volatile and developing market, Carter Jonas’ brokerage platform helps clients to find the best export PPA prices, as well as options for sleeving and import contracts. This week's latest on the UK & EU gas, UK power & renewables and the oil & carbon markets, in partnership with PPAYA.

Weather

UK temperatures are expected to drop over the next few days, falling well below seasonal norms until the end of the week. However, the outlook for next week's weather looks more promising.

Gas

Front-Month: 99.7p/th | Summer25: 96p/th | Winter25: 102.7p/th

A slight downward movement was observed in yesterday’s trading session, as market uncertainties persist amidst ongoing tensions in the Middle East. Additionally, prices now appear to have factored in the anticipated end of Russian gas exports via Ukraine from January 2025 - especially since the Ukrainian Prime Minister's recent confirmation of this in a joint press conference with his Slovakian counterpart, which has also put the proposed deal with Azerbaijan at risk. Meanwhile, the Dutch TTF month-ahead contract remains relatively stable, trading at €39.6/MWh.

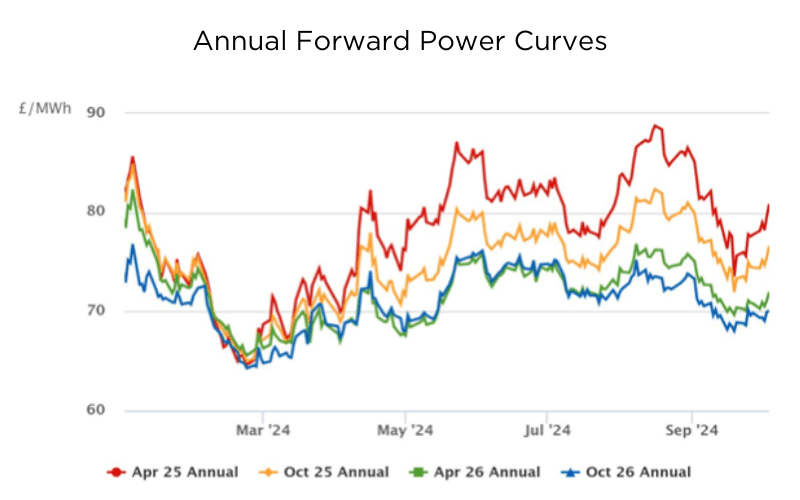

UK Power & Renewables

Front-Month: £85/MWh | Summer25: £75.5/MWh | Winter25: £85.3/MWh

UK power prices saw a modest downward revision yesterday, driven by the intrinsic link between power and gas prices, with bearish sentiment further strengthened by the National Grid's assurance that the UK has sufficient energy supplies for winter. Wind output is forecast to increase over the next few days, though it is expected to decrease again over the weekend.

Regarding nuclear availability, both Sizewell B Reactor 1 and Hartlepool Reactor 2 are currently on planned outages, with Sizewell B Reactor 2 also scheduled to go offline later this month.

Oil & Carbon

Brent Crude: $79.5/bbl | EUAs: €60.7/t | UK Credits: £35.3/t

Crude oil surged yesterday, nearing the $80/bbl mark as markets remain on edge over escalating tensions in the Middle East. Speculation about a prolonged conflict in the region has heightened concerns about potential disruptions to global supplies. Additionally, the risk of attacks on Iran’s oil infrastructure - critical to global output - has driven the closing of short positions, further contributing to rising prices.