Energy security is back at the forefront of political debate in the UK as the government juggles rising energy prices and dependence on energy imports. Jacob Rees-Mogg, UK Business and Energy Secretary said, “The global headwinds caused by Russia’s war in Ukraine, Putin’s weaponisation of energy and the aftermath of Covid, have exposed the need to strengthen Britain’s energy security for the good of the nation”.

The UK government is now taking action to accelerate domestic energy supply and reform the UK’s electricity market. Since taking over as prime minister, Liz Truss has pledged for the UK to become a net energy exporter by 2040 through the use of fracking, expanded nuclear supply and renewable generation. However, at the same time, the government’s Energy Bill, the significant piece of energy legislation which underpins the governments net zero strategy has been reportedly halted or dropped completely to reflect new government priorities.

Ms Truss announced the launch of a new round of North Sea oil and gas exploration licensing with more than 100 licenses issued in an effort to boost domestic production. She also lifted a 3-year ban on fracking in England and planning permission can be sought where there is local support. The ban came into force in 2019 following an outcry over earthquakes at a test site in Lancashire. It is likely that fracking will remain unpopular and controversial even in the current energy crisis. Recent polls found only a third of respondents supported fracking compared with 74 to 81% for wind and solar respectively.

The UK generates about 40% of its electricity from burning natural gas, leaving it exposed to rising gas markets. The wholesale gas price is about 2.5 times higher than a year ago and many in the industry feel that gas prices are not going to go back to the 10-year average. UK gas prices have soared despite only receiving 4% of its gas from Russia. This is down to the how intertwined the UK energy market is with Europe where they rely on Russia for 45% of their gas imports.

High energy prices are attracting investment back to the UK small cap fossil fuel companies as the market has surged since Russia invaded Ukraine. The sector has been struggling in the face of the global acceleration towards renewable energy but a strong focus on energy security has encouraged investment back into the sector.

But for energy companies and the investors, bankers and insurers that finance them, new investment in fossil fuels also presents a challenge given many have made their own pledges to reach net-zero emissions by 2040. In 2021 the IEA (International Energy Agency) advised that there can be no new investments in oil, gas and coal if we are to have a chance of meeting our global foal of limiting global warming to 1.5 degrees.

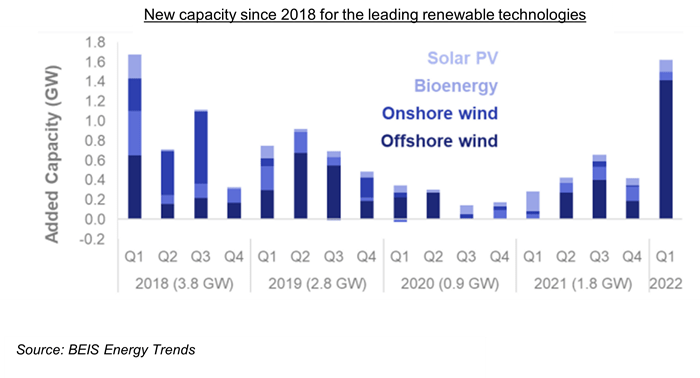

About 40% of the UK’s electricity mix currently comes from renewable energy sources with wind generation being the main contributor. Offshore wind investment has been strong in recent years and capacity has increased significantly this year, largely due to two new wind farms; the first phase of Hornsea Two in England (463MW) and East Moray in Scotland (950MW). Since 2018, offshore wind has dominated the growth in renewable capacity, representing over half (54%) of all new capacity with onshore wind accounting for 16%. Onshore wind development has been in decline since 2015 after the government introduced stricter planning regulations. So far, the new prime minister has been silent on whether she plans to relax planning regulations to boost onshore wind investment.

Renewables are a key part of increasing energy security in the UK and renewable capacity in the UK has grown 8% in the last year. However, wind and solar generation alone have their limitations in providing the constant base load of power needed to supply the country. Therefore, a large and diverse mix of generation sources are needed in order for the UK to be completely secure.

What is clear is that this is a very complex environment made up of a number of components which all need careful consideration. The government faces a real challenge as the country struggles to shore up its energy security whilst sticking to its climate commitments.

To discuss further please contact Helen Moffat on helen.moffat@carterjonas.co.uk.

Read this month's energy news >

Read the latest energy market update >