Economic profile of the OXFORD CAMBRIDGE Arc

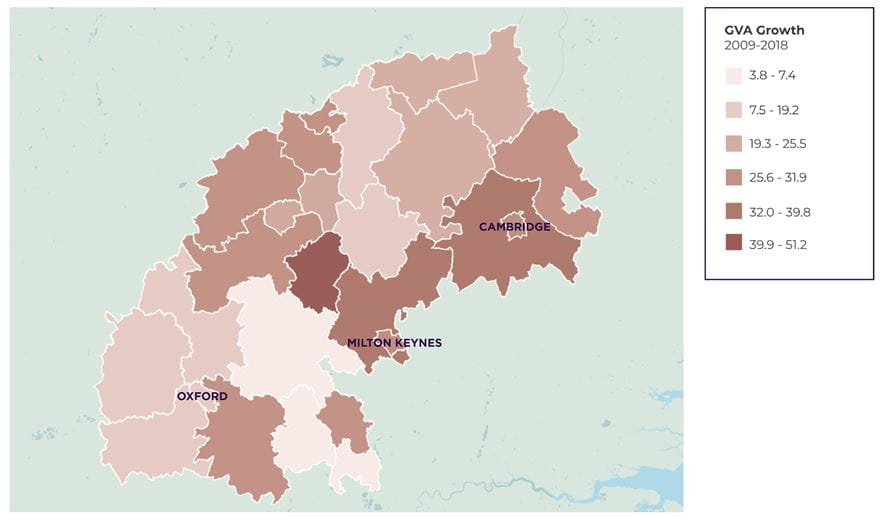

The main Arc locations have thrived, and economic growth has been well above the UK average. Milton Keynes is the UK’s fastest growing city, recording GVA growth of 51% between 2009-18, illustrated in Figure 1. The Oxford Cambridge Arc has witnessed an impressive 25% growth over the same time period and ranks among the highest growth areas within the UK.

Figure 1: 10 year economic growth (2009-2018)

Figure 2 maps this economic growth and identifies the spread throughout the Arc, illustrating the inevitable stronger growth around the main centres, in particular Milton Keynes and the main arterial routes.

Figure 2: Heatmap of economic growth (2009-2018)

Source: Experian Economics

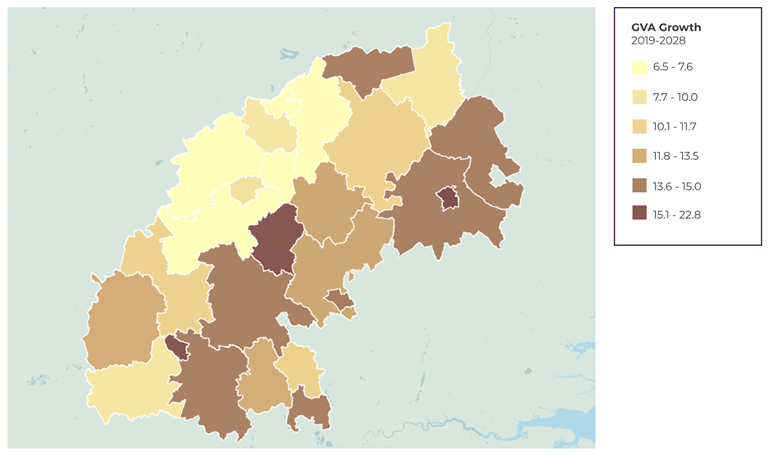

In terms of forecasts, Oxford is projected to lead the way in economic performance, at 23% between 2019-2028, as illustrated in Figure 3. Both Cambridge and Milton Keynes are also forecast to perform strongly, at 20% and 19% respectively. Consequently, the Arc is projected to out-perform the national average, and for its key locations, this outperformance is significant.

Inevitably, there is an element of uncertainty in forecasts, but it should be noted that at current times an unusually high level of uncertainty is evident.

Figure 3: 10 Year economic growth forecast (2019-2028)

The heatmap below (Figure 4) highlights higher forecast economic growth rates in the inner tier of the Oxford Cambridge Arc. Inevitably, growth will be focused on the key centres of Milton Keynes, Oxford and Cambridge. However South Oxfordshire, Aylesbury Vale and South and East Cambridgeshire are also predicted to witness considerable growth due to the ripple effect from the high profile and successful cities.

Figure 4: Heatmap of economic growth (2019-2028)

Source: Experian Economics

Commercial development along the oxford cambridge arc

- Over the last decade, development throughout the UK has been restrained relative to historic levels and the Arc is no exception. That said, opportunities within the Arc are evident and Figures 5 and 6 illustrate the pipeline for both office and industrial stock which currently have planning permission.

- Figure 5 shows the amount of offices within the Arc over 929 sq m with planning permission. Despite being a relatively large area, the cumulative volume of space with planning permission is relatively low and therefore will restrict the potential growth of the Arc moving forwards if not addressed. Potential development activity is focused on six key Local Authorities, with Luton having the largest pipeline comprising four schemes, the largest of which is Newlands Park totalling 162,029 sq m of commercial space. The Vale of White Horse, encompassing Abingdon and Didcot, has a development pipeline of 109,332 sq m divided into five schemes.

- Cambridge has three schemes currently under construction, CB1 on Station Road pre-let to Apple (1,664 sq m) and two out-of-town schemes; at Cambridge Biomedical Campus pre-let to AstraZeneca (50,567 sq m) and plots at Cambridge Science Park (12,913 sq m).

- The majority of the city’s development pipeline is located in the out-of-town market with Cambridge Biomedical Campus, Cambourne Business Park, West Cambridge Research & Development Park and North West Cambridge Development Area (the latter two are both being developed by the University of Cambridge) offering considerable capacity.

- There is almost no commercial construction activity in Oxford. Oxford Science Park’s 2,787 sq m Bellhouse Building has completed, as has the Zeus Building at Harwell, meaning that no space is currently under construction. In terms of Oxford city centre, the development pipeline with planning permission is extremely limited. Whilst no space will come forward over the short-term, there remain two notable medium to long-term development proposals, both located close to Oxford railway station (Oxpens, and at Oxford Station itself). Given the length of time that these schemes will require for delivery, activity will continue to be focussed out of town in the short to medium term.

- However, the wider Oxfordshire market has a sizeable stock of science and business parks, most notably The Oxford Science Park, Milton Park, Oxford Business Park, Begbroke Science Park and Harwell, which all have potential for future phases of development, which is likely to be a combination of speculative phases and design & build. The Oxford Science Park would benefit from the proposed reopening of the Cowley branch line, and has planning consent for a new landmark scheme totalling 15,608 sq m.

- In addition, Legal & General and Oxford University formed a partnership in 2019 to develop homes for University staff and students, together with the creation of science and innovation districts in and around Oxford. The construction of two buildings at Begbroke is anticipated. These total circa 12,000 sq m and will be for both University and commercial users.

- Milton Keynes has no space currently under construction and its development pipeline is dominated by the pre-let development of Santander’s HQ at Grafton Gate. Other notable schemes within the development pipeline include a mixed-use scheme at The Hub:MK on Midsummer Boulvard (27,870 sq m), Eagle Farm North (24,472 sq m) and Railway Works Site (22,500 sq m).

- Most of the remaining Local Authorities have an alarming lack of schemes with planning consent.

Figure 5: Approved office developments by Local Authority

- The industrial pipeline, as illustrated in Figure 6, is equally as targeted towards a handful of centres with Corby topping the list with six schemes in the pipeline, including Cowthick Plantation, owned by Mulberry Developments, which totals 404,100 sq m and Midlands Logistics Park at 250,000 sq m. Other key schemes include Silverstone, whether there is consent for 195,096 sq m. The latest spec phase of 23,225 sq m has just completed, with next phase due to start imminently. Bedford benefits from 12 schemes collectively totalling 632,000 sq m and Northampton 522,000 sq m.

Figure 6: Approved industrial developments by Local Authority

Residential development along the oxford cambridge arc

- Figure 7 shows the number of completed residential dwellings across the Arc since 2008/9. The total number of units completed has systematically risen every year since 2010/11 although of those completions, the proportion owned by housing associations has remained static and not mirrored the growth witnessed in the private sector.

Figure 7: Number of completed dwellings across the Arc

- The residential pipeline is spread fairly widely throughout the Arc, as opposed to both commercial sectors, and highlighted in Figure 8. South Oxfordshire has the highest volume of schemes within the pipeline, including a new town at Harrington which comprises 6,500 dwellings. However, the scheme has yet to gain planning permission and has met a considerable degree of scrutiny, with the timing of an application yet to be confirmed.

- Central Bedfordshire, East Northamptonshire, Milton Keynes and South Cambridgeshire all have significant volumes within the residential pipeline with each of the four Local Authorities having in excess of 9,000 units.

- Bedford, Daventry, Cherwell and Corby each have a pipeline of circa 5,000 units with Northampton at 4,300. At the other end of the spectrum, nine Local Authorities, including Oxford and Cambridge, have a pipeline of less than 2,000 units reflecting the shortage of land available for residential development within the Arc which is a concerning factor. However, in the case of Oxford and Cambridge, these low figures are partly due to having tightly drawn boundaries and the fact that neighbouring districts help meet their housing needs, to a greater or lesser extent.

Figure 8: Residential pipeline of schemes with 100+ units (with planning permission)

What is the Arc setting out to achieve?

The main economic centres along the Oxford to Cambridge Arc are already strong, high-productivity, high-value clusters. However, there are major constraints to development and growth.

The Arc concept is focused around improving east-west connectivity, which has two separate potential benefits:

- Firstly, to link the key centres to enable a functional economic area. There is already a highly skilled labour force which is clearly illustrated by those achieving NVQ4 levels in Oxford (57.9%) and Cambridge (69.5%) compared to a national average of 40.3%. However, a significant issue is the lack of mobility across the Arc due to poor connectivity between the key economic centres, which currently function as largely separate markets, drawing from different labour pools. The cities are physically 90 miles apart and takes almost two hours in a car and 2.5 hours by train via London and includes two changes to connect to each other. Despite the dramatic change in

working patterns due to COVID-19, the connection between the two cities remains vitally important. The Arc is proposed to enable the locations along it to function as a single joined-up and cohesive economic area, integrating the workforces between these centres to enhance growth and productivity.

- Secondly, to enable development along the corridor. The Arc is proposed to accelerate the physical expansion necessary to achieve enhanced growth. This includes delivery of commercial space (office and R&D) and delivery of new housing - the Government’s ambition is for one million new homes to be delivered across the Arc by 2050.

Another, less tangible benefit to the Arc concept, is in raising the global profile of its key locations. The Arc is not only about enabling the formation and growth of indigenous companies but competing globally to attract the best international science and tech occupiers. Silicon Valley remains the undisputed world-leading technology cluster, but global competition is fierce. Among key leading innovations hubs, KPMG list Singapore, Tel Aviv, Tokyo, New York, Shanghai, Seoul and Hong Kong; the only UK location to make the top 20 is London. It is interesting to note all of these foreign cities have a ‘can do’ attitude which allows fast progress, in terms of decision making, infrastructure projects and overall business ethos to be made.

Infrastructure to enable oxford cambridge arc development

Two proposed infrastructure projects underpin the Arc concept: the Oxford to Cambridge Expressway and East West Rail.- The eastern half of the Oxford to Cambridge Expressway (A14 to M1) is complete. However, the route for the western half, from the A34 near Oxford to the A421 east of Milton Keynes was cancelled in March 2021 after analysis confirmed the project was not cost effective.

- East West Rail is a strategic railway which will link Oxford and Cambridge, via Bicester, Milton Keynes (at Bletchley) and Bedford. The rail link is divided into three parts, with Phase 1 of the western section, Oxford via Bicester Village to the junction with the Chiltern Main Line which became operational in 2016 and in April 2020, engineering work began on the Bicester to Bletchley Western section, Phase 2. There is a ‘preferred option’ for the central section from Bedford to Cambridge (chosen out of five possible routes) which runs between Sandy and St Neots on the East Coast Main Line (with potential interchange station), and then via a new proposed station at Cambourne. This could support housing development between Sandy and St Neots and at Cambourne. A more detailed assessment of the precise alignment of the line will now take place.

It is not just transport infrastructure that is important, as there are considerable issues with getting power supply to developments, which will need to be addressed with local distribution companies and the National Grid.

Colin is a Partner and was appointed Head of Planning & Development Division in November 2020, he is based out of our Cambridge office. He has over 25 years’ experience of planning consultancy and has a broad sphere of work. He acts for a wide range of private, institutional and developer clients and has worked on significant planning applications and appeals.

Scott specialises in providing advice on agency and development matters to a wide variety of clients from private individuals and trusts through to property funds, institutions, companies and statutory authorities. He advises both owners and occupiers across public and private sectors.

Working at Board level with clients, Scott’s specialist areas include Business development, development of property strategies, property investment advice, advice in the marketing and disposal of property as well as property acquisitions.

Scott has a particular knowledge and understanding of the property market in the wider Oxfordshire region whilst also operating on a national basis on specific projects.