Whilst for many estates probate is a fairly uneventful process, in some circumstances, it can be lengthy and somewhat demanding. One of the issues that can cause disruption is the valuation of assets.

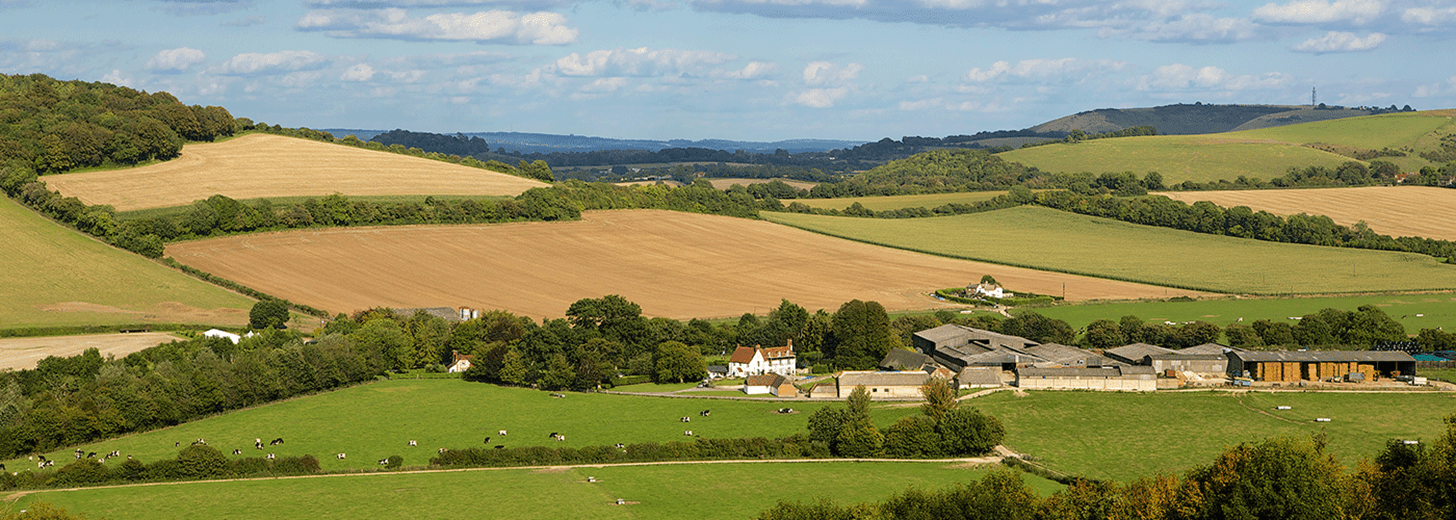

For several reasons, clients can be reluctant to obtain a formal valuation for probate purposes. Many are keen to avoid what they consider to be an unnecessary hassle and expense. Some may already have obtained an informal, and cost-free market value estimate from a local estate agent and consider this sufficient. Such a proposal may be cheaper, however there are risks involved that could become apparent later on.As an example, we were recently instructed by a client to value their portfolio for probate purposes. The main component of their portfolio comprised a smallholding with residential property. An estimate of £650,000 had already been received from an estate agent.

However, when inspected, and through the assessment of the asset following RICS valuation regulations, potential issues concerning protected lifetime tenancies that would impact on the value became apparent.

The location of the part subject to the lifetime tenancy effectively restricted any ability to “lot” the asset (lotting being a consideration when undertaking a market value assessment). Ultimately, the valuation of the asset concerned was £475,000, a difference of £125,000 (21%) of the estimated figure obtained.

Issues can also occur if HMRC challenges the valuation of assets on tax returns. Such challenges can be referred to the Valuation Office Agency (VOA) for review, including the valuation of assets for inheritance tax (IHT) returns submitted on the occasion of a death.

Negotiations between the VOA and executors may sometimes result in a higher value being agreed than that included in the IHT return. In these circumstances, if it is decided that the executors have not taken reasonable care in ascertaining the value of the asset, HMRC can charge a penalty of up to 100% of the potential tax loss.

HMRC guidance assumes that a reasonable person would seek professional help with matters such as valuations, and advise instructing a professional valuer for IHT purposes. The valuation of an asset for probate is generally considered as the base cost of the asset for capital gains tax purposes for those inheriting the asset. It will, therefore, have a bearing on the tax position of the beneficiaries of the estate in the future.

In relation to these matters it is always advisable to seek assistance. Whilst there will be an initial outlay, given the importance placed on valuations, it is nearly always worth it.

For more information, contact Jack Sharpe or your local Carter Jonas office.