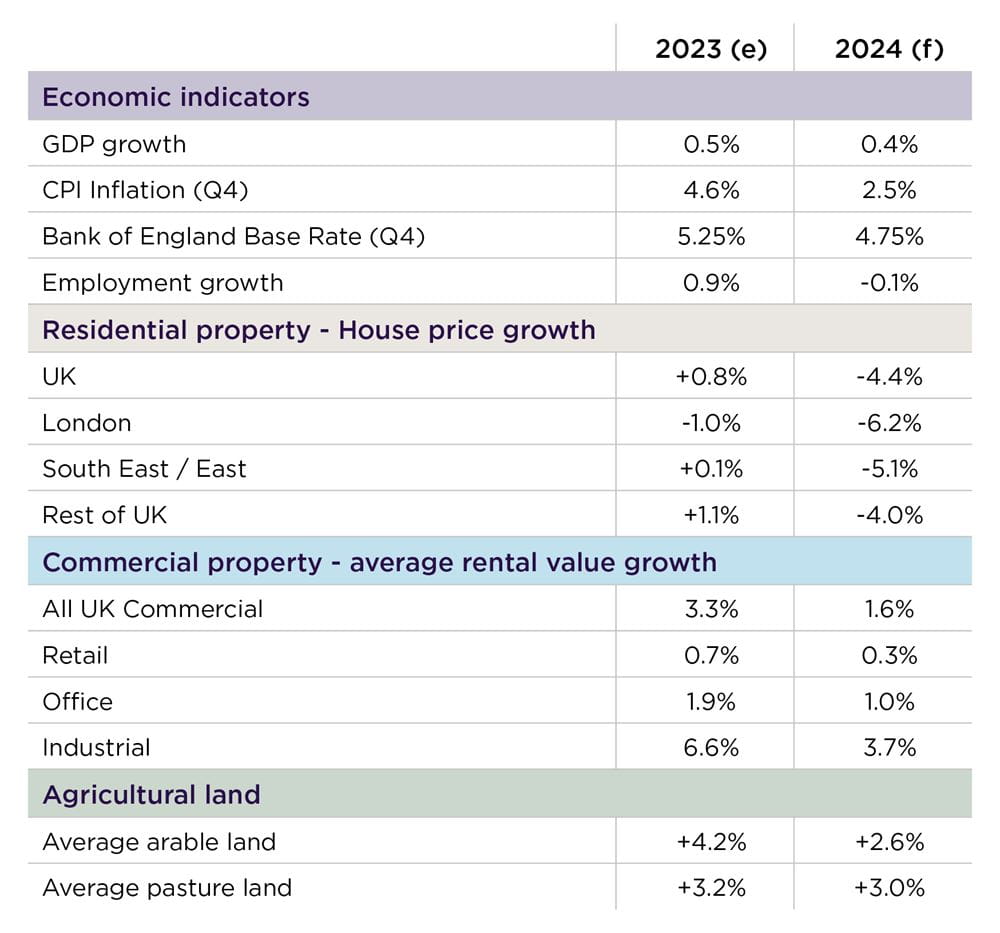

Average house prices across the UK are projected to decline by approximately 4.4% in 2024, following growth of around 1% in 2023 and robust growth of over 8% in each of the preceding two years. This implies that even with some price reductions, by the end of 2024, house prices will still be approximately 21% higher than they were pre-pandemic.

Regionally, London prices are anticipated to experience the steepest decline by the end of 2024 at -6.2%, with all other southern locations facing price deteriorations greater than those in the northern regions (excluding Northern Ireland). Nonetheless, demand is expected to rebound strongly, largely in line with anticipated interest rate reductions, resulting in house price gains of around 1.3% in 2025 and nearly 5% the following year.

Rental growth in the commercial property sector will again be spearheaded by the industrial sector, as continued strong competition amongst occupiers for both existing and new build product helps to maintain upward pressure on rental values despite the subdued economic outlook. We forecast average industrial rental value growth of 3.7% in 2024, well above the all-property average of 1.6%, although a deceleration from an expected 6.6% in 2023.

The retail and office sectors are also forecast to see modest positive average rental growth, at 0.3% and 1.0% respectively. For office property, occupier demand will be focussed on top quality, well-located city-centre space, of which there is little available supply. The current dearth of new development will mean continued upward pressure on prime rents, and the gap with rents for poorer quality stock is likely to widen further.

For agricultural land, we expect only a modest slowdown in the rate of growth in 2024 compared with 2023. Pasture land values will benefit from natural capital gains, while arable supply may shrink as farmers assess profitability and take land out of production, exerting upward pressure on values.

Source: Experian, HM Treasury Consensus, Real Estate Forecasting Limited, Carter Jonas

Our forecasts project the following indices: Residential – HM Land Registry House Price Index; Commercial – the MSCI Annual index; Rural – the Carter Jonas Residential Land Value Index

Colin is a Partner and was appointed Head of Planning & Development Division in November 2020, he is based out of our Cambridge office. He has over 25 years’ experience of planning consultancy and has a broad sphere of work. He acts for a wide range of private, institutional and developer clients and has worked on significant planning applications and appeals.

Mark Hall-Digweed heads the Infrastructures department, where he has developed the team to deliver project management, land agency and property consultancy services to utility, public sector bodies and civil engineering organisations. The team is very successful and has grown to attract large clients such as Network Rail. Mark was also appointed in 2010 to lead Carter Jonas’s cross divisional Public Sector Group, where he is responsible for developing clients with complex multi-faceted requirements.

Marks primary skills include multiple site management, high level negotiation and dispute resolution, programme management and the implementation of new systems, estate management, as well as compulsory purchase and compensation work. He has high levels of experience in all of the above.

Scott specialises in providing advice on agency and development matters to a wide variety of clients from private individuals and trusts through to property funds, institutions, companies and statutory authorities. He advises both owners and occupiers across public and private sectors.

Working at Board level with clients, Scott’s specialist areas include Business development, development of property strategies, property investment advice, advice in the marketing and disposal of property as well as property acquisitions.

Scott has a particular knowledge and understanding of the property market in the wider Oxfordshire region whilst also operating on a national basis on specific projects.

Tim is head of the firm's Rural Division and of the Cambridge office, although he spends a considerable amount of time in London. He has over 20 years experience in advising institutional and private clients on a very wide range of rural business issues, including sales and purchases, strategic advice and valuations. He often works with specialists in other divisions of the firm to provide clients with a fully integrated property service. Tim lives near Newmarket and has a keen interest in country pursuits, encouraged constantly by his two children.