Energy news - September 2025

- Data centre market: Growth, opportunities and challenges

- Recent energy headlines

- Can renewables meet the UK's needs by 2030

- Charities Act - Designated Advisor's Report for renewables

- New starters

- Upcoming events

Data centre market: Growth, opportunities and challenges

Introduction and context

The UK is entering an important period as it ramps up growth in the data centre market. This is being driven by the demand for artificial intelligence (AI), cloud services, and high-speed digital infrastructure accelerates. The private sector is responding with unprecedented levels of investment. This includes:

- Microsoft spending around £80bn on DCs in 2025.

- Meta has committed £65bn.

- AWS is investing £8bn in UK-based facilities.

Currently, DCs account for around 2% of UK electricity demand, but this is forecast to rise to 14% by 2035. 5GW of capacity is required by 2030 alone. The government is therefore looking to establish Growth Zones, identifying locations where land, power and policy alignment can unlock development at scale. However, the industry is not convinced that these will drive development in the ‘right’ locations from their perspective.

The main constraint is the co-location of land and grid capacity. The national grid queue is slowing the development pipeline significantly, with developers increasingly turning to innovative solutions such as co-locating battery energy storage (BESS) with data centres to bypass connection delays.

Power costs are another competitive issue. In comparison with Nordic countries, where power is abundant and cheap, the UK faces relatively high operating costs. For context, a single 100MW data centre requires the same power as 35 shopping centres or Sheffield’s residential demand. This scale of consumption is driving interest in new generation technologies such as Small Modular Reactors (SMRs).

Town and Country Planning (TCPA) vs Nationally Significant Infrastructure Project (NSIP) Consenting

The Ministerial Statement made on 12 December 2024 by the Minister for Housing and Planning, Matthew Pennycook MP, confirmed that the Government will “follow through with prescribing data centres, giga-factories and laboratories as types of business or commercial development capable of being directed into the Nationally Significant Infrastructure Projects consenting regime, depending on the scale of the project”. This statement was significant in the context of the wider consenting regime for data centre development, following on from data centres being confirmed a Critical National Infrastructure (CNI).

The current National Planning Policy Framework (NPPF) specifically acknowledges at paragraphs 86 and 87 that planning policies and decisions should pay particular regard to facilitating development to meet the needs of the modern economy and strategically plan for such development. As such there should be more local level support for CNI.

The NSIP route would certainly help remove much of the ambiguity experienced at the local decision-making level, whilst providing a clearer, more logical approach to consenting at the Central Government level. However, the NSIP route can be long and costly. The details in respect to the applicable scale of data centre development that could constitute NSIP projects is yet to be confirmed. This detail will likely come through during the course of 2025. Most recently, consultation commenced on 1st September 2025 into expediting and simplifying the consenting process for major infrastructure projects through amendments to the consultation and examination process for Development Consent Orders (DCOs).

How our Energy Team support data centre development

The Carter Jonas Energy Team understand the challenges facing data centre development and the work required to unlock new sites across the country. We combine expertise in site acquisition, planning, and energy infrastructure to provide end-to-end support for both developers and landowners.

For developers

We help developers overcome the two biggest barriers to delivery: finding suitable land and securing grid connections. Our services include:

- Site searching & feasibility: Identifying land parcels with the right balance of availability, planning potential, and access to grid infrastructure.

- Grid connection applications: Managing applications and engaging with DNOs and NESO.

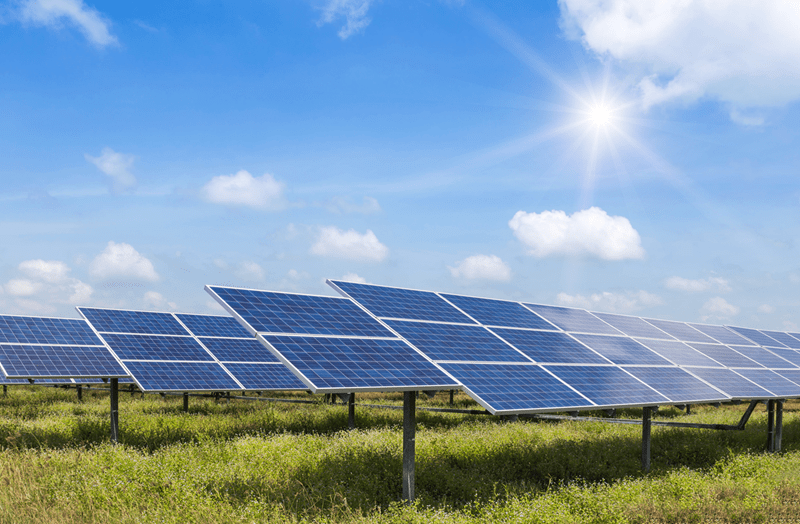

- Renewable energy co-location: Advising on opportunities to co-locate DCs with renewable energy projects to improve energy costs and reduce strain on the grid network.

- NSIP and planning advice: Providing guidance on whether projects fall within NSIP thresholds and managing strategies for either the DCO or local planning system pathways.

- Partnerships: Working with leading legal, technical, and financial advisers to structure agreements.

For landowners

Data centre demand is creating new opportunities for landowners with sites located near electrical infrastructure, fibre connectivity, or within potential government growth zones. Carter Jonas can support landowners by assessing land potential, negotiating agreements and leveraging developer relationships.

In addition to grid and land available, consideration needs to be given to access, existing DC infrastructure, flood zones and other environmental constraints.

Conclusion

While the growth of the DC sector is already underway in the UK on the back of AI developments and cloud storage, there are still many more sites needing to be developed. There are ongoing challenges around grid capacity, energy pricing, and planning, however, the opportunity for landowners and developers who act strategically now is significant.

Carter Jonas is well placed to guide stakeholders through this complex landscape, providing the land, grid, and agency expertise needed to unlock projects that will define the future of UK’s digital economy.

Recent energy headlines – Gate 2, power requirements by 2030, cost of curtailment and more

Close of the first Gate 2 grid application window

The first Gate 2 application window under the grid Connections Reform, led by the National Energy System Operator (NESO), closed on 26th August. This reform is designed to reduce grid connection queues, streamline processes, and accelerate the delivery of renewable energy projects. By moving to a “first ready, first connected” approach, developers are required to meet clear parameters before qualifying for a grid connection offer.

As part of this important milestone, the Carter Jonas Energy Team is proud to share its involvement in the signing of over 4GW of energy development land option agreements for submission to this Gate 2 window.

UK’s largest solar park becomes operational

At the start of July, Cleve Hill Solar Park became fully operational. The solar park spans almost 900 acres of land in north Kent, near Faversham and has a 373MW capacity. The solar park is expected to power over 102,000 homes.

Curtailment costs UK hundreds of millions in wasted wind energy

In the first half of the year 4.6TWh of renewable energy was curtailed. Curtailment is where renewable generators are required to reduce or stop producing electricity, usually due to balancing requirements to ensure grid stability. Northern Scotland accounted for 86% of the UK’s curtailment and were paid to shut off almost 40% of their potential electricity output. Octopus estimates that the cost of wastage, through curtailment this year to date exceeds £800 million.

Ofgem approve CMP477

Ofgem approved CMP 447 in June 2025, allowing it to move forward on an accelerated timeline. This proposal, raised by the National Energy System Operator (NESO), deals with how costs are shared for major grid upgrades. At present, developers can face large cancellation charges and financial guarantees if projects don’t go ahead. CMP 447 changes this so that for big, strategic upgrades that benefit the whole energy system, those costs are not unfairly pushed onto individual developers.

Can renewable energy meet the UK’s power needs by 2030?

Back in June, Philippe Rottner, a member of the energy team at Carter Jonas wrote an article about the UK’s renewable energy market and its path toward meeting almost all electricity demand through renewables by 2030. It underlines the investment and grid upgrades needed, alongside the growing role of wind, solar, and storage. Read the full article below:

Can renewable energy meet the UK's power needs by 2030? | Journals | RICSCharities Act – Designated Advisor’s Report for Renewables

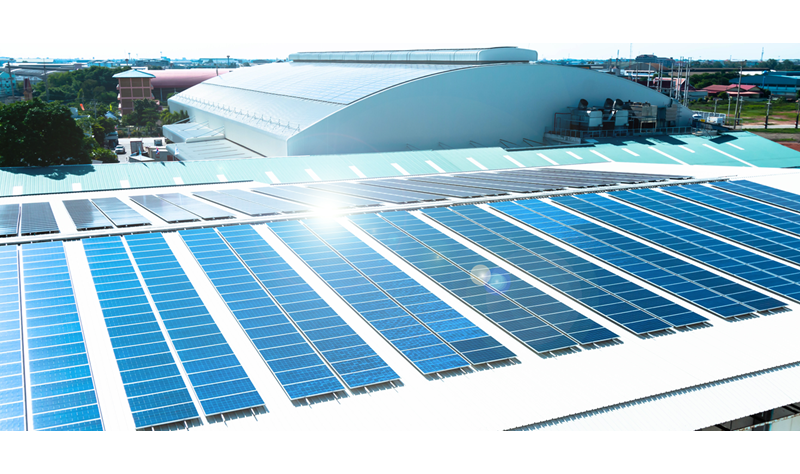

In accordance with the Charities Act registered charities are required to obtain a report known as a Designated Advisor’s Report (‘DAR’) prior to any disposal of property interests exceeding 7 years. This, therefore, includes any leases for renewable energy developers which are typically granted for terms in excess of 25 years.

Recently Carter Jonas have seen a rise in enquiries for DARs relating to third party funded private wire renewable installations. This concept involves a third party paying for the installation of a solar array or wind turbine on a property and then contractually agreeing to sell the electricity generated to the building owner at a favourable rate compared to electricity imported from the grid. The mechanism for this concept involves the renewable energy provider taking a lease over the building owner’s property (usually roof space) at a peppercorn rent and then concurrently signing a Power Purchase Agreement (‘PPA’) with the Charity. As the lease is usually in excess of 7 years the charity must obtain a DAR. Clearly a lease with no rent does not have a value, however, the value comes in the form of the electricity cost savings that are realised through the PPA.

Carter Jonas is experienced in providing DARs to assess this type of lease / PPA. Our reports also involve in-depth data analysis to assess how realistic the proposed savings are.

If you have any questions relating to this topic please contact Harry Robertson, 07920861774.

New starters

Will Warde-Norbury, a former Carter Jonas placement student rejoins the Energy Team as a Graduate in Leeds.

Will Hunt joins the Energy Team as an Energy Specialist, specialising in energy transactions. He will be based in London.

Upcoming events

Simon Tarr, Development Lead and Jamie Baxter, Technical Advisory Lead will attend the Solar and Storage Event at the NEC in Birmingham at the end of September. Please get in touch if you would like to meet up.

Contributors

|

Charles Hardcastle 07969 354368 |

Jamie Baxter 07598 580511 |

Helen Moffat

Associate Partner 07467 335587 |

Thomas Pipe

Graduate Energy Specialist 07801 167725 |